Content

To do this, go into the total value of bucks and you may low-cash money on your Setting 1040. So it amount is going to be joined on the “Other Money” point. If you did found an application W-2G, you are going to transfer specific guidance to your Function 1040. A growing group of Uk bookies in addition to their greatest opportunity, easily under one roof.

- The fresh Kelly Criterion try a well-known gambling strategy you to definitely decides the fresh optimum choice for sort of selections making use of their earn chances.

- Right now, you understand the solution to so it question for you is—unfortunately—“Yes.” That being said, only a few taxation and you can costs are made equal.

- In addition, it can be applied simply to casual bettors, instead of experts who are believed mind-employed and you will shell out a projected income tax for each quarter.

Bullet robins perform apparently limitless quantities of parlay bets! An 8 foot round robin having a couple bets in the for each parlay create manage twenty-eight independent parlay wagers, all with the exact same share. You could potentially confirm esports bet at home gambling loss on your KY taxation by space the details in the a comfort zone and make certain one everything create betting wise is filed and you may reported. For individuals who keep all receipts and passes, up coming itemizing playing losses within the Kentucky is pretty easy. Anyone who gains more than $5,one hundred thousand to the people better away from lottery online game within the Kentucky have a tendency to forego 6% of your own continues so you can Kentucky bodies since the income tax. Loss do not surpass profits, so that you never get into a position your location ready to expend smaller taxation than just you’ll if you didn’t play whatsoever.

Esports bet at home – Bang for your buck Calculator Helps you Track Your investment returns And you can Losses

You’lso are permitted to deduct losses only to the level of the new betting profits you claimed. Therefore, if you acquired $dos,100000 however, destroyed $5,100, your itemized deduction is bound in order to $dos,000. You could potentially’t utilize the leftover $step three,000 to attenuate your most other taxable income. You must allege $2,100 in the earnings in your Mode 1040 after which individually allege $2,100000 since the an enthusiastic itemized deduction.

How to use Betting Coms Lucky 15 Calculator

Bet365 Real time Streaming Plan – Watch alive athletics, as well as sports and you may pony race. Dutching Calculator – Get the stake necessary on every of your bets to guarantee a predetermined funds. You opt to choice all in all, $twenty-six to the a good Canadian wager, and therefore $1 for each of your own 26 bets.

Sevenfold Bet Calculator – Estimate potential winnings to own sevenfold wagers. The primary benefit of utilizing the Fivefold Choice Calculator is that it quickly and you will precisely offers the possibility payment for a good fivefold bet. In the event the Fantasy, Destiny, and you can Wonders all of the win the new races, you would be given out for the around three doubles and another treble that people choices perform – an entire come back from £forty-two.31, and you will full profit of £33.30. If Fantasy and Fate try your only successful choices, would certainly be paid out to the you to twice that they create. Everything else was amount as the a loss of profits, so that your full return was £8.49 and you’ll be sitting baffled of £2.51. When considering chances out of a gamble, you will notice possibly an advantage (+) otherwise without (-) beside the number.

Try Gambling Profits Subject to Taxes In the Louisiana?

When selecting your outcomes to possess a Yankee bet, it’s crucial that you believe individuals items for example team mode, user wounds, head-to-direct analytics, and you will pro study. Conducting thorough look and you will analysing the fresh offered information can help you generate informed selections while increasing your odds of a profitable Yankee bet. The brand new calculator tend to quickly provide prospective payouts for for every you’ll be able to benefit. When you document their 1040 on the taxation season, include the matter withheld because of the payer, because the government income tax withheld. You place 10 Increases, 10 Trebles, four Five-Flex accumulators plus one Four-Fold accumulator.

Hence, if you are installing an every means wager, you ought to put both win part and put region of your own choice separately. The new Per Method Calculator device establishes such bet to you personally centered on the rear chance at the bookie, the brand new place odds at the gambling change and also the amount of towns provided. Perhaps not revealing gambling payouts is actually akin to not reporting any kind cash. It is a citation out of both state and federal law and you can at the mercy of charges such as fines or in extreme situations, jail date. Wonderful County residents need not pay condition taxation on the Ca State Lottery winnings, however, federal fees try due. Those individuals winnings manage enter while the normal earnings and you can effortlessly rating taxed in the federal income tax rates of your champ.

Sort of Wagering Calculators

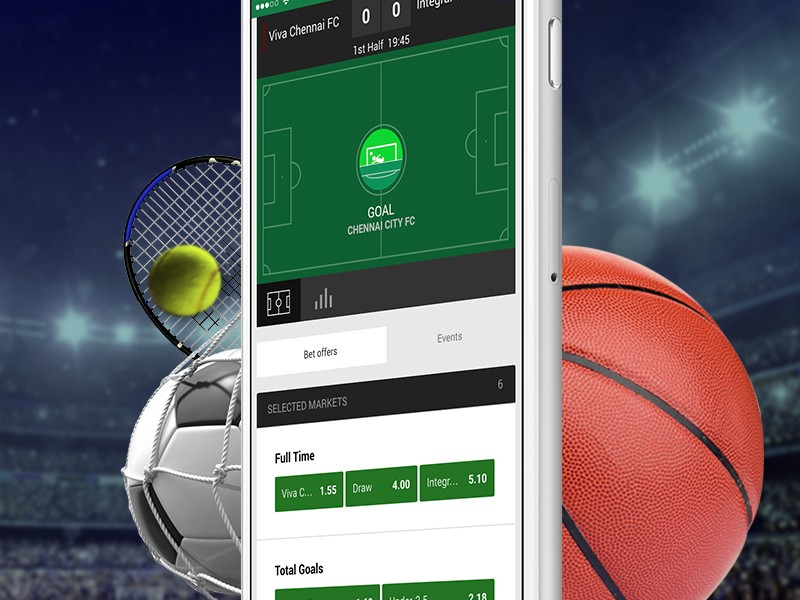

If or not you’re a novice learning the new ropes or an expert refining their means, so it equipment is free of charge and you may representative-friendly, so it’s possible for you to build better-advised gaming behavior. A wager earnings calculator will help you work out how far you might winnings if your wager succeed. By inputting their share and the chance, that it bet calculator tend to quickly tell you exactly what your funds would be in case your wager is a champion.

An enthusiastic designed opportunities ‘s the portion of times you might must winnings a bet regarding wager to breakeven. You’re allowed to deduct betting loss in order to all the way down the amount of income tax you have to pay for the playing earnings. The fresh endurance speed and this invokes fee of Kentucky gambling profitable taxes varies depending on the sort of choice.

This is the way WSN produces money in buy to carry on getting beneficial and you will reliable content to possess activities gamblers and you may players. The brand new payment we found will not effect all of our recommendations otherwise information. All the details to the WSN will always be are still unbiased, purpose, and you may separate. A per ways choice is split up into a couple wagers, a win-just choice and an area-only choice, therefore be mindful whenever placing for each and every way bets since your risk usually effectively become twofold.