Posts

Their assistant would be accountable for reacting and you will following the through to your entire concerns today and informal just after. Your fulfillment is our very own priority plus research from your/the girl will determine their job rating. Customer can get shell out ½ away from deposit prior to services initiation as well as the harmony for the very first costs. Do not are Social Protection number otherwise one individual otherwise confidential guidance. That it Google™ translation element, considering to your Business Taxation Panel (FTB) webpages, is for general advice simply.

Delight see a duplicate of your own arrange for the full words, standards and you may exclusions. Coverage circumstances are hypothetical and revealed to possess illustrative motives only. Coverage is based on the actual items and points providing increase to a state. Shell out a tiny monthly fee as little as $5 rather than a large upfront defense deposit. Conflicts always go just before a judge (there are no juries) in 30 days otherwise a couple. Residents get sue on the security put count which they trust the owner wrongfully withheld, to the official’s limitation.

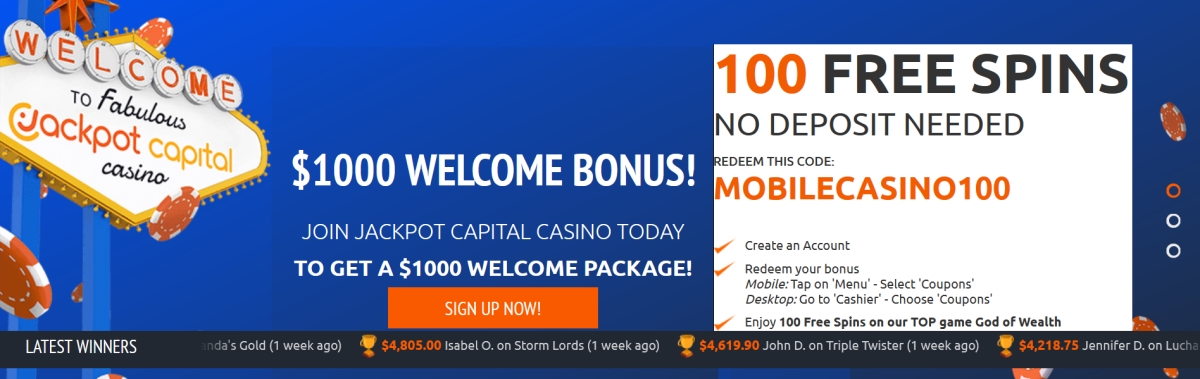

Deposit 1 get bonus | Personal Protection Benefits

Particular $5 put casinos make it people in order to claim incentives as high as $20. Incentives like this allow you to gamble above you could have in just a $5 put. The level of the put cannot impact the outcome of the game. Yet not, it does most likely take you a few more gains to help you cash out an adequate amount at the a good $5 minimum put gambling establishment. Although not, you can come across specific video game in some 1 dollar put casinos having the very least bet which is more than the fresh $5 you transferred. It usually is good to consider for every online game’s requirements and you can limitations in advance, so that you don’t happen to invest the $5 deposit to your a casino game you can not enjoy.

Attach a copy of government Setting 1066 to the straight back of the brand new completed Setting 541. Home Withholding Declaration – Energetic January 1, 2020, the true property withholding models and you can recommendations had been consolidated on the you to the newest Function 593, A property Withholding Statement. The financing are fifty% of your number provided because of the taxpayer to the taxable season for the College or university Availability Taxation Borrowing Financing. The level of the financing are allocated and you may official because of the CEFA. For more information visit the CEFA site in the treasurer.california.gov and appearance to have catc.

Withholding to your Idea Money

The dedicated account movie director and your Panama attorneys have a tendency to go with and you can show you by this techniques.If you would like utilize your organization, we will deal with the process for you. Don’t were withholding out of Versions 592-B otherwise 593 or nonconsenting nonresident (NCNR) member’s taxation of Schedule K-step one (568), Member’s Share deposit 1 get bonus of money, Deductions, Loans, an such like., range 15e with this line. IRC Section 469 (which Ca integrate because of the site) essentially limitations write-offs away from couch potato items on the number of earnings produced from the couch potato points. Furthermore, credits away from inactive items is actually limited by taxation attributable to for example things. These limitations is actually first applied in the home or trust peak. Obtain the instructions to possess federal Function 8582, Couch potato Interest Loss Constraints, and government Function 8582-CR, Passive Hobby Borrowing Limits, for additional info on passive things losings and you will credit restriction laws.

Our very own $5 minimal deposit online casinos experience constant audits to own game fairness and user security. Among the known certificates you to secure the faith are the ones from the united kingdom Gambling Fee, the fresh MGA, and the iGaming Ontario or AGCO license. We advice seeking out it render, particularly if you like to play slot games.

A lot more Advantages of choosing Baselane

A homes perimeter work with has payments for you otherwise on the account (along with your family members’ should your family life along with you) simply for another. All of the wages and just about every other payment to own services did in the All of us are thought as of offer in the United States. The only real conditions to that signal are talked about lower than Team away from foreign individuals, organizations, otherwise offices, later, and you may less than Staff professionals, before. Most of the time, bonus income gotten from home-based businesses is actually You.S. origin earnings. Dividend earnings out of overseas organizations is often international source income.

Moneylines

These types of earnings could be excused of You.S. income tax or may be subject to a lesser rates out of income tax. To decide taxation to your nontreaty income, shape the brand new income tax in the possibly the fresh apartment 29% rates or perhaps the finished rates, depending upon whether the income are effortlessly related to your own trade otherwise organization in the united states. A great nonresident alien would be to fool around with Function 1040-Es (NR) to find and you can shell out estimated tax. For those who shell out because of the take a look at, make it payable to help you “All of us Treasury.” If you think that the notice-a job income is actually subject simply to You.S. self-a career income tax and that is exempt of international social security taxation, request a certification away from Publicity regarding the SSA. That it certification will establish your exception of international public protection taxes.

All the details in this book isn’t as full to have citizen aliens because it’s to have nonresident aliens. Resident aliens are usually addressed just like You.S. people and can see more information various other Irs books in the Irs.gov/Models. When you build a deposit, you will get 80 totally free spins since the an advantage.

The new believe software brings one investment gains are placed into corpus. 50% of the fiduciary charge is actually spent on income and you may fifty% to corpus. The fresh trust sustained $step one,500 away from miscellaneous itemized deductions (chargeable to money), which can be subject to the 2% floor. The fresh trustee generated a great discretionary shipment of your bookkeeping earnings away from $17,five hundred on the trust’s sole beneficiary. Deductible management costs are those will set you back that have been sustained inside union for the administration of your own property otherwise faith who not were sustained should your possessions just weren’t kept in such home otherwise believe. Trust expenses per outside investment guidance and financing administration charges is various itemized write-offs susceptible to both% floor.

Matches incentives otherwise deposit matches incentives usually suit your $5 deposit casino better-as much as a specific the total amount, typically at the fifty% otherwise a hundred%, whether or not most other proportions can get implement. While you are this type of also provides are typical, they wear’t constantly stretch since the far having smaller dumps, so you may maybe not understand the exact same raise as with large top-ups. Ruby Fortune try an excellent $5 deposit local casino one to guarantees the new acceptance added bonus away from C$250. We recommend that it gambling enterprise because also provides more than 1,100000 video game and you can a cellular software. Based in the 2003, it’s one of the best $5 deposit gambling enterprises inside the Canada. Join All of the Ports Gambling enterprise and you may discover a c$1,five-hundred within the bonus money give round the very first about three dumps, as well as 10 totally free revolves each day and you will an attempt at the profitable to C$1,100,000.